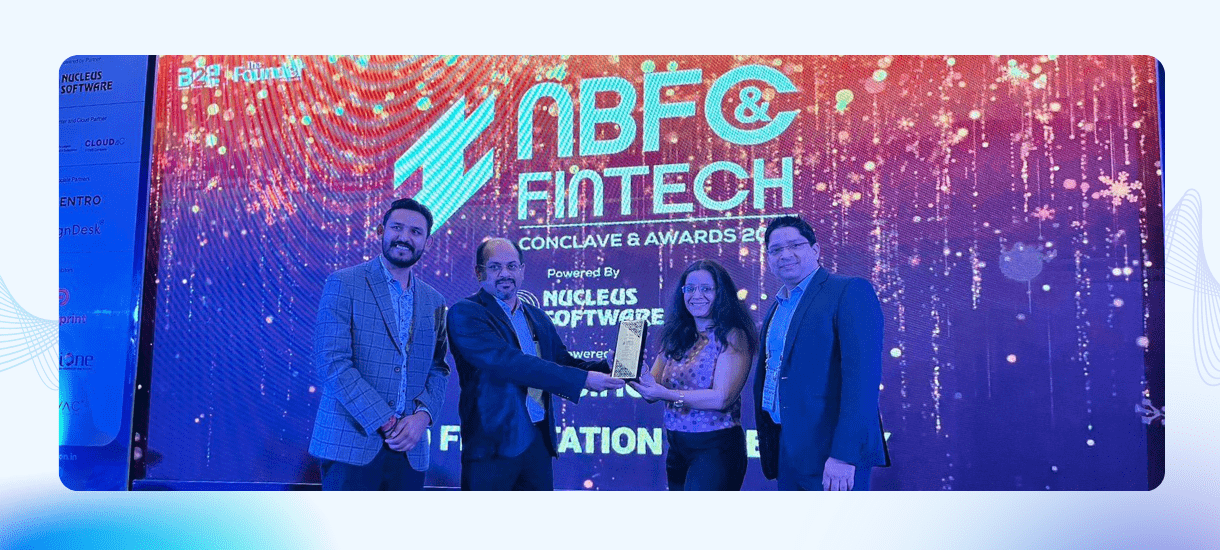

New Delhi, India – Aug 9, 2024 – Nucleus Software, the BSE & NSE listed, India’s leading provider of lending and transaction banking solutions to the global financial services industry, today announced its dual achievement by winning the two prestigious awards ‘Best FinTech of the Year’ and ‘Best Fintech & NBFC collaboration’ with Tata Capital Ltd at esteemed 17th NBFC & Fintech Awards, 2024 on 16th July in Chennai. This accomplishment underscores Nucleus Software’s commitment to reshaping the financial services landscape and propelling growth for global financial institutions through robust technologies and innovative approaches.

The NBFCs & Fintech Conclave and Awards is one of the leading events that explores various facets of technology from present to future development and its efficiency. The discussion of the 17th edition of the awards was focused on the pivotal aspects of technology. It has delved into NBFCs’ strategies for digital lending, co-lending, and leveraging technology to serve the masses. Eminent experts from the NBFC and IT sectors engaged in thought-provoking dialogues, sharing their invaluable insights through comprehensive panel discussions.

The banking and financial services landscape is undergoing profound transformation driven by digitalization, regulatory changes, and increasing customer expectations. The advent of digital technologies such as artificial intelligence (AI), blockchain, and cloud computing is revolutionizing how financial services are delivered, making them more efficient, secure, and customer-centric. Regulatory initiatives, including the Unified Payments Interface (UPI) and the push towards open banking, are fostering a more inclusive and competitive financial ecosystem.

This dynamic environment necessitates continuous innovation to build a robust, seamless and agile financial ecosystem that can swiftly adapt to the market’s evolving demands. Nucleus software, with its rich legacy and proven expertise has been at the forefront of this transformative journey with innovative solutions and a strategic focus to enable financial institutions to navigate this complex landscape successfully by leveraging advanced technologies.

On winning the two awards Mr. Ashwani Arora, Sr. Vice President, Nucleus Software Exports Ltd. said, “We are thrilled to be awarded the ‘Best FinTech of the Year’ award and the ‘Best Fintech & NBFC Collaboration Award’ with Tata Capital at the 17th NBFC & Fintech Awards, 2024. It is an double honour that fills us with great pride and gratitude. This recognition highlights the distinctiveness of our solutions in advancing economic progress through strategic application of technology. Our objective is to constantly explore pioneering ways, ensuring we not only uphold a leading position in the competitive landscape but also consistently deliver exceptional value to financial institutions and to end customers. The future holds immense potential, and we are dedicated to driving this positive change and shaping the future of financial services.”

Nucleus Software’s innovative approach to lending and transaction banking solutions ensures it meets the evolving needs of financial institutions while providing a flexible, secure, and efficient platform for managing financial lifecycles. With over 540 out-of-the-box APIs, for seamless integration and automation, Nucleus Software’s solutions enhance operational efficiency and customer experience. Nucleus Software is adopting proven principles of Lean manufacturing in software development. By implementing Acceptance Test-Driven Development (ATDD) and moving towards continuous integration and continuous delivery (CICD), Nucleus Software aims to redefine software development methodologies. Through these advancements, the company is committed to setting industry benchmarks and driving innovation in the financial services sector.

About Nucleus Software

Nucleus Software Exports Ltd. Is a publicly traded (BSE: 531209, NSE: NUCLEUS), software product company that provides lending and transaction banking products to global financial leaders.

Nucleus Software delivers disruptive Fintech Solutions to 200+ Banks and Financial Institutions across 50 countries supporting Retail, Corporate & SME Finance, Islamic Finance, Automotive Finance, Captive Automotive Finance, Cash Management, Mobile & Internet Banking, Transaction Banking and more. We facilitate over 26 million transactions each day through our globally integrated transaction banking platform. Our lending platform manages US $ 500 billion of loans in India alone, and over US $700 billion of loans globally other than India, while enabling 500,000+ users to log in daily.

Our Flagship Products FinnOne Neo® and FinnAxia® are backed by 3 decades of BFSI domain expertise and an inbuilt AI powered platform to realize the digital transformation goals of FIs worldwide.

- FinnOne Neo®: The next-generation digital lending platform, designed to revolutionize the lending process. FinnOne Neo® is built on an advanced technology platform, empowering financial institutions to streamline their lending operations, enhance customer experiences, and drive business growth.

- FinnAxia®: An integrated global transaction banking suite, trusted by banks worldwide to optimize their transaction banking processes. With FinnAxia®, financial institutions can efficiently manage their cash management, trade finance, liquidity management, and other transaction banking activities on a single platform, thereby improving operational efficiency, visibility, and enhancing client relationships.

- PaySe®: The world’s first online and offline digital payment solution, created with the vision to democratize money. This innovative payment solution offers users a seamless and convenient way to conduct digital transactions, both online and offline, facilitating financial inclusion and empowering individuals and businesses.

- Nucleus Software Services: Our comprehensive suite of services is tailored to assist banks and financial institutions in their digital transformation journey and maintain an optimal technology infrastructure. Through Nucleus Software Services, we offer a holistic approach to digital transformation, enabling organizations to deliver seamless customer experiences, achieve operational and cost efficiencies, and gain actionable insights to drive strategic decision-making.

These offerings collectively underline Nucleus Software’s commitment to driving innovation and empowering financial institutions to thrive in an increasingly digital world.

For Media related information, please contact:

Deepika Gulabani

Corporate Communications

Email: deepika.gulabani@nucleussoftware.com

Phone: +91-9310334963

Lending

Lending

Transaction Banking

Transaction Banking Financial Inclusion

Financial Inclusion